Through the Looking Glass: A Guide to Software Development in Ukraine 2023

Contents

Contents

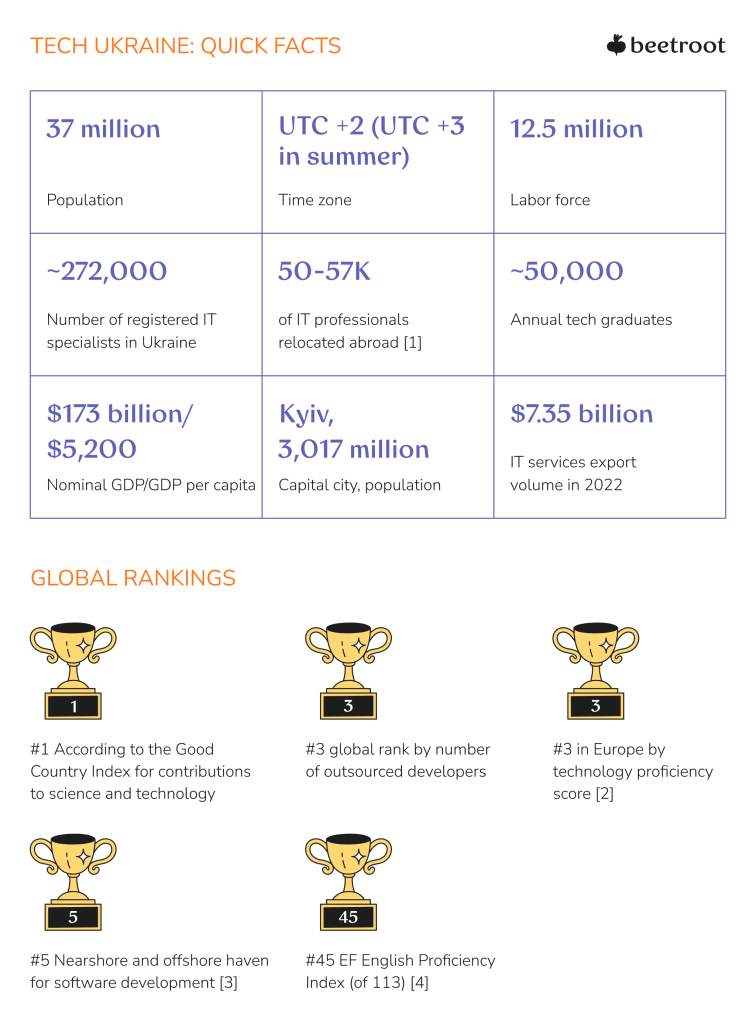

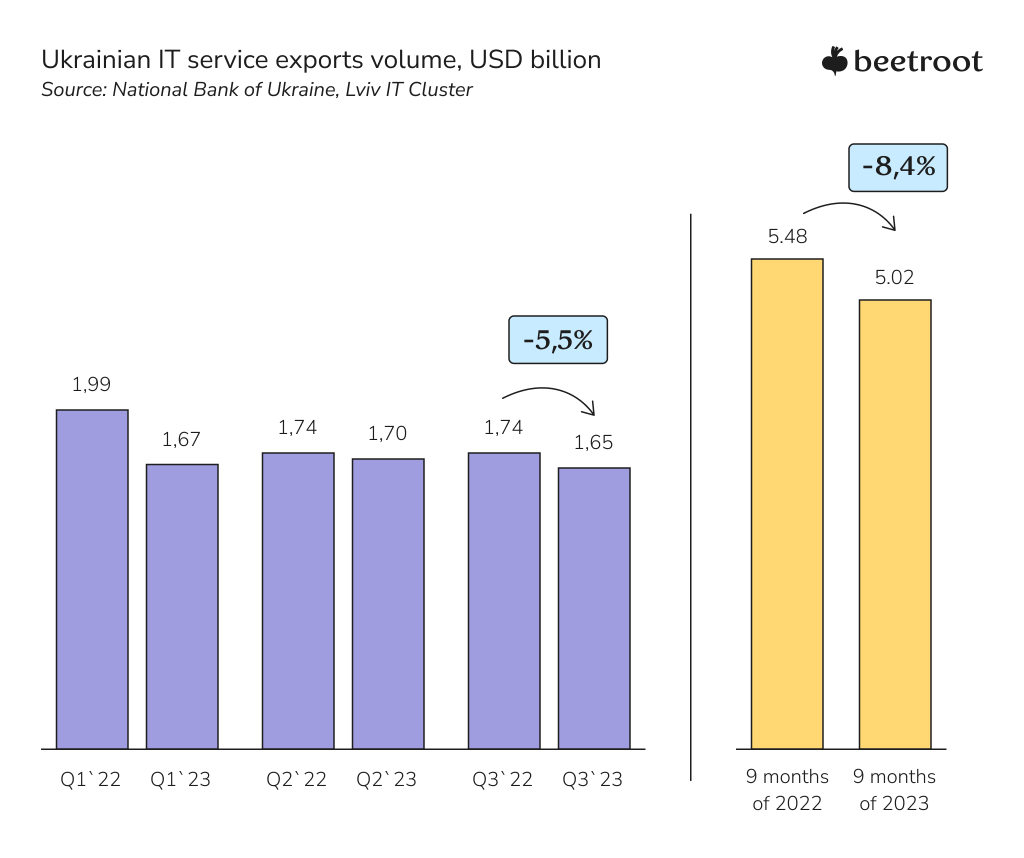

Our previous Guide to Software Development in Ukraine, released three months into the war, highlighted the IT industry’s exceptional resilience. Fast forward, the sector earned a record $2 billion in export volume in Q1’22 and managed to sustain and even increase the revenues to $7.35 billion by the end of 2022. Despite the general volatility in Ukraine’s external trade, the IT sphere has remained relatively stable, comprising 45.4% of 2022 service exports.

Russia’s invasion has severely impacted Ukraine’s economy, causing a GDP decline of over 30%. However, the country perseveres. In today’s overview, we will examine Ukrainian Tech’s present state and trajectory — the highs and lows, the talent pool, and reasons why, despite the hardships, doing business there remains a feasible choice.

Overview of the Ukrainian IT industry

In 2022, the IT sector maintained around 96% of service contracts, and 77% of companies attracted new clients during wartime. Indeed, Ukrainian IT businesses and their foreign counterparts have already adapted to operating under the conditions of a full-scale war. However, those who have chosen Ukrainian software development vendors are not turning a blind eye to the risks.

The data from the National Bank of Ukraine revealed a 16% drop in IT service exports in the first quarter of 2023 compared to the same period in 2022. This downward trend indicates that 2023 will mark the first year the Ukrainian IT market will not demonstrate growth. The decline can be attributed to the global recession, exacerbated by the continuing war. Furthermore, the annual nature of contracts adds to the complexity, making it difficult for businesses to plan for the future.

The USA and UK remain key markets for Ukraine’s IT exports. Notably, many of their companies are registered as tax residents in Malta and Cyprus, also the leading IT service importers. The Nordic countries (Denmark, Sweden, Norway, and Finland) consistently rank in the top 20 of Ukraine’s export partners. At the same time, Poland and Estonia maintain a substantial presence in IT exports, particularly because many tech companies establish local entities that import Ukrainian IT services.

As Kostyantyn Vasyuk, the former Executive Director of the IT Ukraine Association remarked on the situation in the export sector:

“Our IT industry has retained expertise and personnel in Ukraine, but to maintain competitive advantages in the global market, this is not enough, so companies are forced to develop foreign offices to retain existing ones and attract new customers. However, in Ukraine, IT companies are actively investing in new developments in defense-tech and cyber security fields. Although such projects do not increase the export indicators of the budget, they do much more – they create new, unique products for the future and help defend our country today.”

IT companies

Estimates from various sources indicate that Ukraine is home to between 2,000 and 5,000 IT companies. The government’s Tech Ecosystem Overview lists 2,300 companies. Only 12 of them have ceased operating since the start of the full-scale invasion, and 43% expect growth in 2023. Ukraine has already produced seven active unicorns, two of which confirmed their status during the war, and more than ten unicorns-to-be are about to complete their valuation.

Startups

The 2022 study by Polish-Ukrainian Startup Bridge revealed that most startups in Ukraine operate in industries related to the development of new technologies and computer software. The report surveyed 158 enterprises, 87.3% of which have been in the market for less than five years. The top 5 verticals in which Ukrainian startups are most active are SaaS, MedTech, AI, Energy, and IoT.

Tech cities

Over 20 Ukrainian cities have active IT clusters and communities. The biggest ones reside in the country’s largest cities: Kyiv, Kharkiv, Lviv, Odesa, and Dnipro. However, there is an ongoing trend of emerging IT clusters and hubs in midsize cities, including Poltava, Ivano-Frankivsk, Vinnytsia, and Kremenchuk. The evolution of the tech infrastructure in Ukrainian regions strengthens the industry’s social and economic impact.

Ukraine as a digital country

In recent years, Ukraine has prioritized digitalization as a key focus and national objective. The Ministry of Digital Transformation spearheads this effort with a determined ambition to establish a “state in the smartphone.” Ukrainians were the pioneers of using digital IDs and other documents, and the country holds the top spot globally for the number of public services accessible online. The state-level digitalization goals by 2024 are:

- 100% public services available for citizens and businesses online;

- 6 million Ukrainians involved in digital skills development programs;

- 95% of citizens and settlements have access to high-speed internet;

- $6.5-$17 billion share of the IT sector in Ukraine’s GDP.

The Tech’s contribution to national defense and security

In 2022, approximately 3% of Ukraine’s 285,000 to 300,000 tech professionals enlisted in the Armed Forces; 12 to 15% now contribute to the country’s cyber defense. Ukraine’s IT ecosystem, honed through years of countering Russian cyber attacks, has become pivotal to national security.

A prime example of high-tech and military integration is Brave1, a unified platform initiated by Ukraine’s government and the army authorities to advance defense technology. Launched in April 2023, Brave1 has garnered significant interest, receiving over 780 applications from startups, 420 of which have passed the Armed Forces of Ukraine expertise. Brave1 allocated 84 grants totaling $1.53 million this year and plans to invest $39 million in 2024 in various DefenseTech startups, from weapon systems and UAVs to security, demining, robotics, and medical support.

“Ukraine should become a country that rapidly develops, learns, and actively uses technology. The creation of BRAVE1 is one of the important steps in this direction,” said Mykhailo Fedorov, Deputy Prime Minister for Innovation, Education, Science and Technology Development and Minister of Digital Transformation, presenting the cluster. “Our goal is to build a system for the rapid launch of defense tech projects. To take bold decisions and create the best conditions for the development of companies developing military technologies,” he continued. “Technology and courage can do a lot for our victory.”

Overview of the tech talent pool in Ukraine

Despite the forced mass relocation and emigration due to the invasion, the number of registered private entrepreneurs in IT grew by 13% in 2022, totaling 272 thousand, with this number increasing. The favorable taxation system and competitive rates of Ukrainian engineers, coupled with their extraordinary commitment to business obligations even under extreme conditions, have significantly bolstered their reputation among international clients. As one of our partners aptly commented, “Pressure = innovation fueled by motivation.”

Key demographic details of Ukrainian IT specialists

The average age of IT professionals in Ukraine is 29. The “youngest” sectors are Data Science, Security, ERP/CRM, Customer Success, and Sales (median age: 27), while older professionals more often work as DBA (median age: 38), CTO/Director of Engineering (34), and DevOps/System Administrators/Technical Writers (32). Geographically, 83% of these professionals reside in large cities: Kyiv, the capital (36%), Lviv (18%), Dnipro (6%), Odesa (4%), and Kharkiv (3%). About 10% of Ukrainian IT specialists are currently living abroad.

A decade ago, the Ukrainian tech industry was predominantly male (92%). By 2022, the share of women in IT had grown to 23.4%, with a notable rise in private female IT entrepreneurs (78.6 thousand). While women traditionally are more represented in non-technical areas like HR, design, marketing, and sales, they also have a share in QA, software development, GameDev, and other technical roles. We delve deeper into this topic in our article exploring the state of female representation in the IT sector across three of Europe’s leading outsourcing destinations — Ukraine, Bulgaria, and Poland.

English proficiency

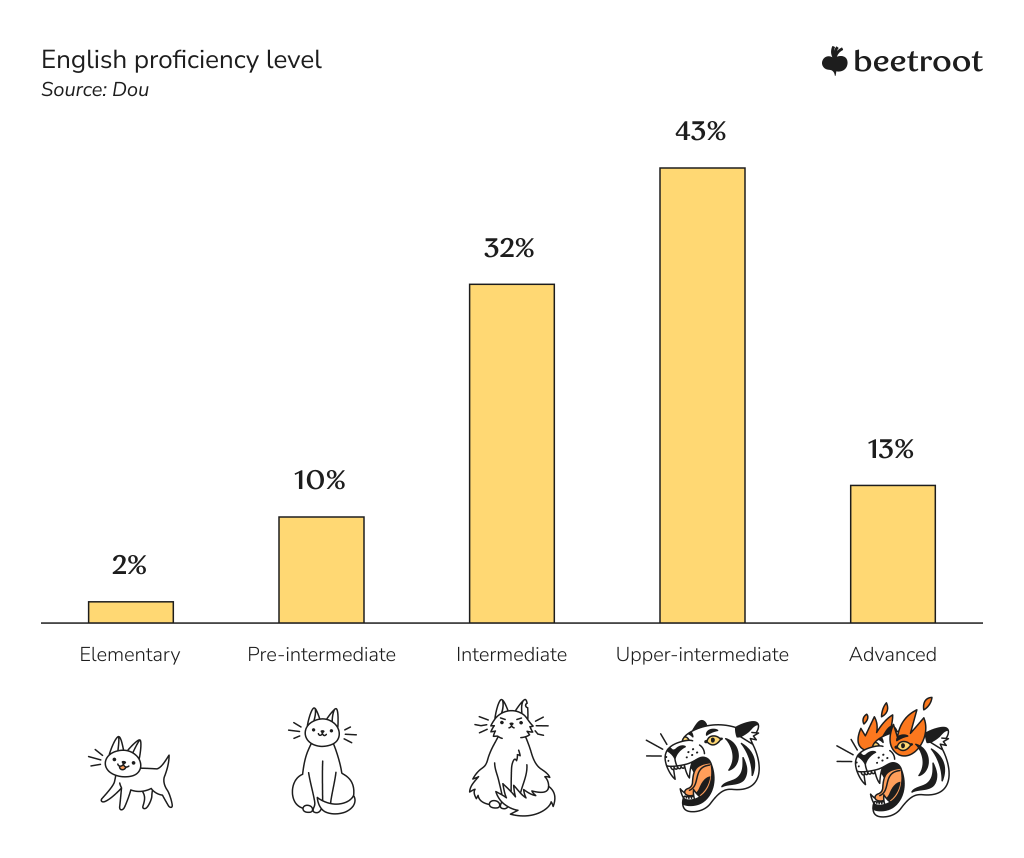

Ukraine is positioned at #45 in the EF English Proficiency Index, with most Ukrainian tech specialists possessing a minimum of B2 level English. This proficiency is essential for entry into the industry and serves as the official language for communication with international partners.

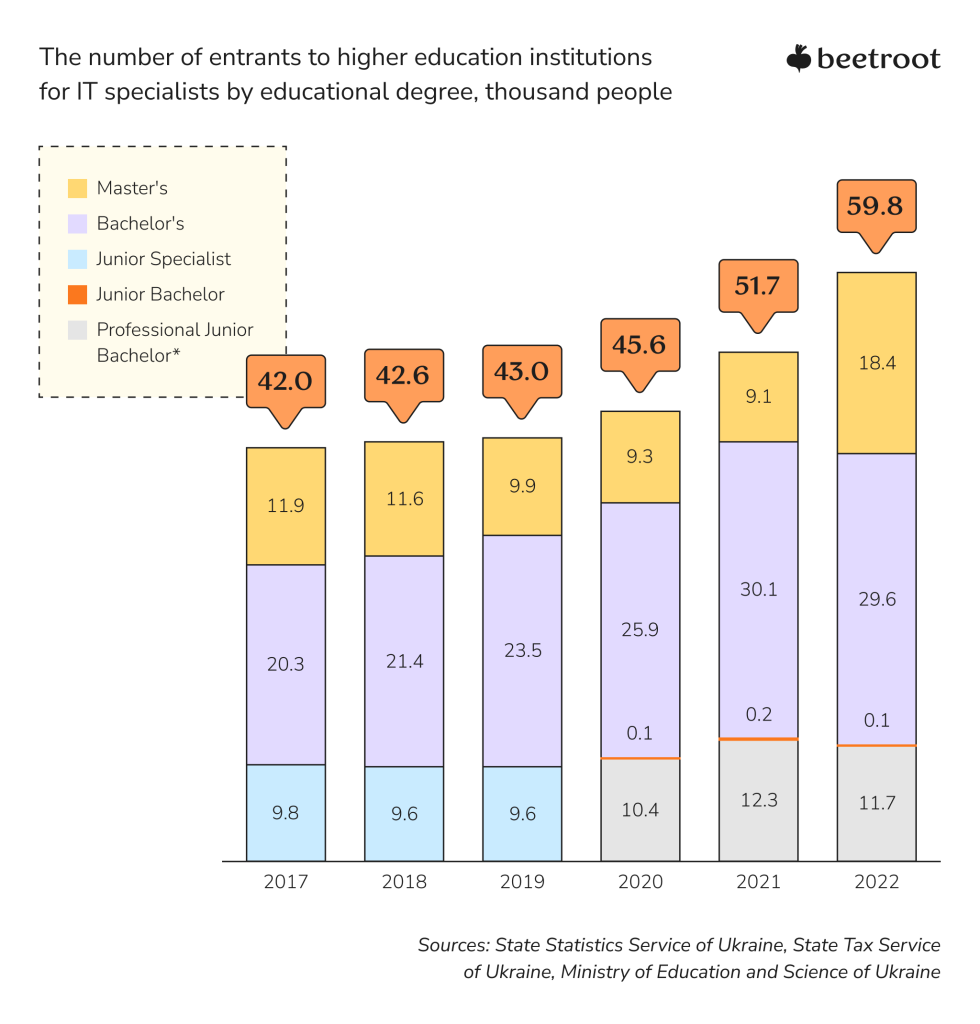

IT education

The Ukrainian Tech Ecosystem lists around 400 educational institutions offering IT education programs and/or courses for various competence levels. Most of these organizations concentrate in large cities. Despite debates on the need for higher education in IT, 88% of Ukrainian tech specialists hold university degrees, some with multiple or doctoral diplomas. Beyond tertiary education, 79% of IT professionals continue to upgrade their skills through online or offline courses and training.

Private IT education

Ukraine has a thriving ecosystem of private IT schools and programs for tech enthusiasts. Many schools have offered free courses, scholarships, and sponsorships in response to the full-scale war. These initiatives cater to diverse groups, including internally displaced persons, veterans, women, victims of violence, and other vulnerable populations.

A prime example is the IT Generation project by Ukraine’s Ministry of Digital Transformation. It aims to provide thousands of Ukrainians with free (sponsor-funded), high-quality IT education, helping them start a successful tech career. Of the 117 schools that applied, 21 were selected, including Beetroot Academy. From our 82-student quota, over a third have already found employment, with this number increasing. Some of the most popular IT education centers include EPAM University, Projector, Mate Academy, GoIT, IAMPM, Logos IT Academy, and more.

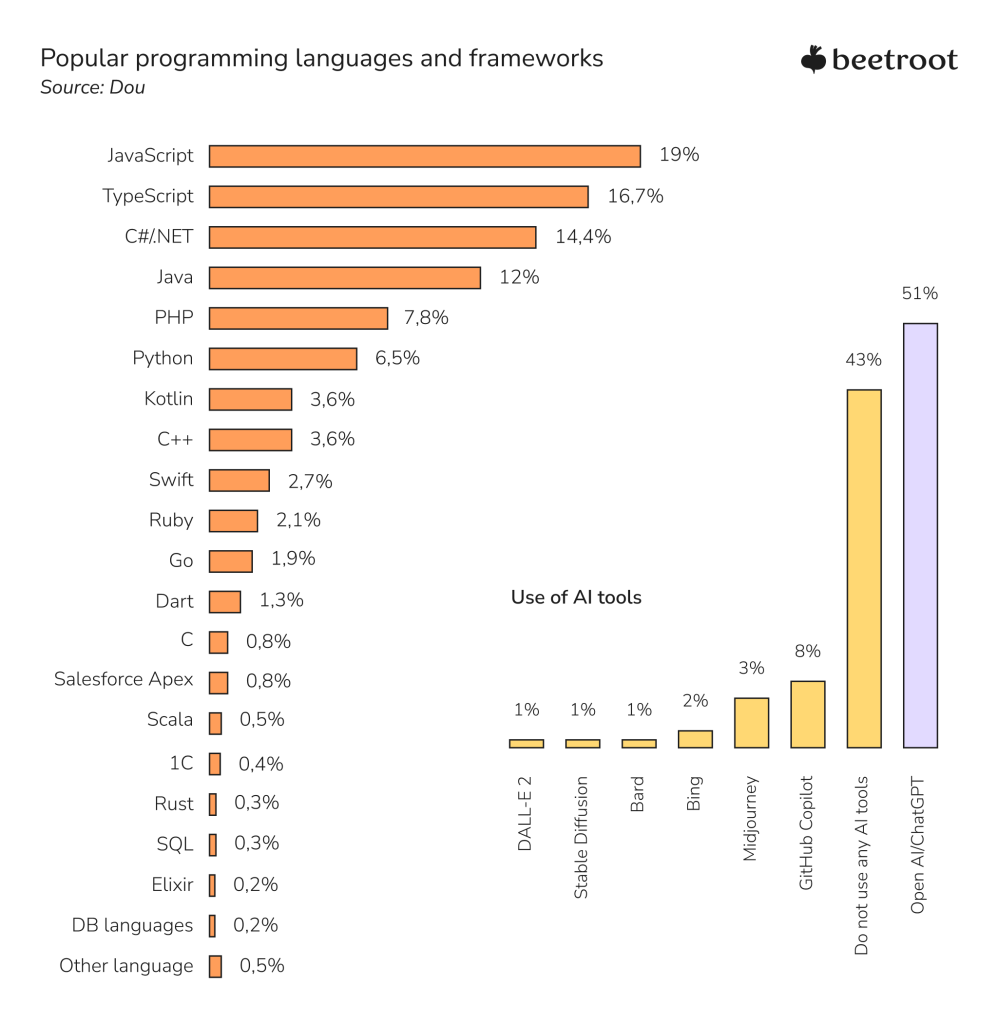

Popular programming languages

According to a survey conducted among IT developers in May— June 2023, JavaScript is gradually losing its dominance in development. TypeScript is gaining traction as the primary language for 17% of developers. JavaScript and TypeScript remain favorites among front-enders: 53% mainly use JavaScript, while 43% favor TypeScript.

C#/.NET ranks third in usage frequency, chosen by 14% of developers and 25% of full-stack engineers. Java and PHP also gradually lose their positions, though Java remains the go-to language for 27% of back-enders. The top language of back-end specialists is Python, while mobile developers prefer Kotlin (33%) and Swift (28%).

The cost of hiring dedicated software developers in Ukraine

Ukrainian IT professionals are traditionally praised for their world-class engineering skills, cultural adaptability, cost-effectiveness, and — not least — innovation and adaptability to new trends. Most Ukrainian developers primarily partake in outsourcing and outstaffing projects, so we calculated the approximate cost of hiring developers via development partners (as dedicated teams) based on the from-the-field information.

Under this cooperation model, the service provider is responsible for managing talent sourcing, planning, provision of equipment, onboarding, team care, and retention. Such a setup offers prompt access to a broader range of services and a more extensive talent pool, encompassing QA engineers, project managers, and non-technical consultants using the partner company’s sourcing channels.

The average monthly cost of hiring dedicated developers by programming language, USD

| Junior | Middle | Senior | Team/Tech Lead | System Architect | |

| JavaScript | $2310 – $2970 | $3630 – $5270 | $5830 – $7700 | $6050 – $8250 | $8070 – $9350 |

| Java | $2530 – $3180 | $3850 – $5420 | $6070 – $8250 | $7150 – $8800 | $8470 – $10450 |

| Python | $2380 – $3280 | $3850 – $5500 | $6110 – $8470 | $6600 – $8800 | $8210 – $9490 |

| C#/.NET | $2420 – $2970 | $3740 – $5280 | $5940 – $7800 | $6600 – $8250 | $8250 – $10120 |

| TypeScript | $2420 – $2970 | $3850 – $5500 | $6270 – $8250 | $6600 – $8800 | $6660 – $13200 |

| PHP | $2510 – $3300 | $3520 – $5060 | $5670 – $7180 | $5830 – $7700 | $8290 – $8350 |

| Kotlin | $2200 – $3130 | $3850 – $5500 | $6160 – $8250 | $6050 – $8310 | $8470 – $9900 |

| C++ | $2530 – $3170 | $3850 – $5370 | $6050 – $7560 | $7170 – $9350 | $7080 – $8670 |

| React | $2530 – $3520 | $3300 – $4400 | $3850 – $6050 | $5500 – $7700 | $7920 – $9460 |

| Go | $2420 – $2860 | $3960 – $6330 | $6930 – $10140 | $7180 – $9190 | $7790 – $11970 |

The ballpark monthly cost of hiring dedicated developers by specialization, USD

| Back-end | Senior SE: $7150 Middle SE: $4730 Junior SE: $2750 |

| Mobile development | Senior SE: $7040 Middle SE: $4460 Junior SE: $2750 |

| Front-end | Senior SE: $6880 Middle SE: $4400 Junior SE: $2700 |

| Full-stack | Senior SE: $6880 Middle SE: $4380 Junior SE: $2730 |

| Data processing | Senior SE: $6660 Middle SE: $4180 Junior SE: $2530 |

| Data annotation | Senior SE: $2600 Middle SE: $2360 Junior SE: $1995 |

Impact of talent relocation and emigration

The Russian attacks and gruesome bombings of the civilian infrastructure forced millions of people to seek shelter and assistance abroad or in safer parts of the country. Since February 2022, nearly 3.7 million Ukrainians have been internally displaced, and as of November 2023, about 6.32 million refugees from Ukraine were recorded globally.

Zooming into IT, between 55 and 57 thousand tech specialists have left Ukraine since the start of the war. Of 2,760 IT professionals surveyed by DOU, 34% settled in Poland. Other most favored destinations include Portugal, Germany, Spain, the United Kingdom, and Czechia.

As of August 2023, the IT labor market of Ukraine has recovered by 57%, with record-breaking competition among job seekers. However, the number of vacancies still significantly falls behind the pre-war level, correlating with the settlements’ proximity to the front line. Notably, the competition among job seekers in Ukraine’s IT sector is much higher than the national average (sometimes 30x the market average) — quite a contrast to the labor market’s skilled worker shortage. For employers, however, this presents a unique opportunity to select top talent and build motivated teams, which can contribute to growing businesses while keeping their country afloat.

Final remarks

The war has profoundly affected the global economy and severely undermined startup activities: Ukraine dropped from 34th to 50th place in StartupBlink’s 2022 global startup ranking. However, the state’s resilience helped it climb to the 49th position in 2023, surpassing Hungary and Serbia. To survive, Ukraine has to move faster than many others combined. And, unfortunately, at a very high cost. As Andreas Flodström, Beetroot’s founder and CEO, has put it:

“Many companies and entrepreneurs I meet show interest in investing in Ukraine “after the war.” However, there’s no reason to wait, especially when it comes to tech. Since the war began in 2014, Ukraine has produced seven unicorns, with 2 becoming unicorns after the full-scale invasion in 2022, and another 15 or so are on the way. The war doesn’t stop the Ukrainian tech industry from innovating. In fact, the opposite is happening.”

With nine international R&D locations, Beetroot has the capacity to strengthen your tech resilience by building diverse engineering teams that last — you can find more information in our portfolio. And if you’re interested in hiring dedicated software developers in Ukraine, we’re here to help — let’s get in touch.

Subscribe to blog updates

Get the best new articles in your inbox. Get the lastest content first.

Recent articles from our magazine

Contact Us

Find out how we can help extend your tech team for sustainable growth.